Popular Keywords

- About Us

-

Research Report

Research Directory

Semiconductors

LED

Consumer Electronics

Emerging Technologies

- Membership

- Price Trends

- Press Center

- News

- Events

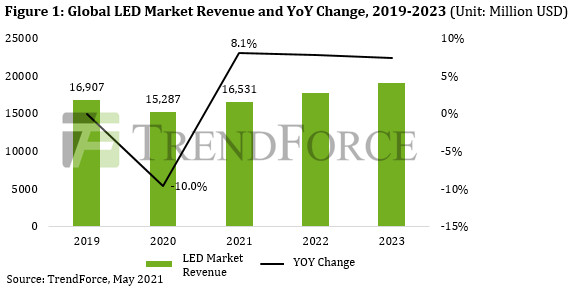

Owing to the impact of the COVID-19 pandemic in 2020, not only did LED revenue experience a downward trajectory, but this decline also reached a magnitude rarely seen in recent years, according to TrendForce’s latest investigations. However, as vaccinations begin taking place in 1H21, the LED market’s long-stifled demand is expected to rebound from rock bottom. Hence, global LED market revenue will likely undergo a corresponding recovery this year as well, with a forecasted US$16.53 billion, an 8.1% increase YoY, in 2021. Most of this increase can be attributed to four major categories, including automotive LED, Mini/Micro LED, video wall LED, and UV/IR LED.

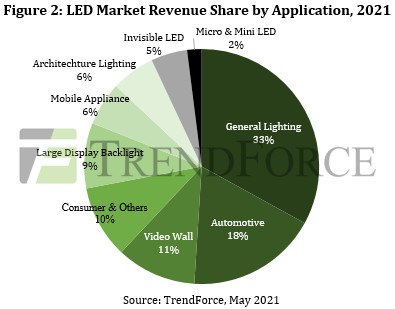

TrendForce expects the soaring growth of NEV (new energy vehicle) sales and the accelerated adoption of LED lighting solutions in new models of conventional fossil fuel vehicles this year to result in a persistently rising penetration rate of automotive LED solutions since 2020. Automotive LED revenue for 2021 will likely reach $2.93 billion, a 13.7% increase YoY, making it the fastest growing sector among all LED applications.

Demand for emerging Mini/Micro LED technologies in display applications, on the other hand, has been skyrocketing this year. In particular, the latest 12.9-inch iPad Pro and Samsung TVs both feature Mini LED backlighting technology, and these products will propel Mini/Micro LED revenue for 2021 to $380 million, an impressive 265% increase YoY, in turn giving the Mini/Micro LED sector the second largest growth among the four categories. Coming in third place is the video wall market. Emerging solutions, such as all-in-one LED display for meeting and conference, 5G 8K ultra-high resolution video walls, home theaters, and virtual production, have placed the video wall market in the spotlight in recent years. Video wall LED revenue for 2021 is expected to reach $1.78 billion, a 12% increase YoY and the third-largest growing sector in the LED industry.

It should be pointed out that, among all segments of the UV/IR LED market, the UV-C LED segment has garnered significant attention due to the onset of the pandemic. Not only have various brands been gaining a major awareness of the importance of disinfection and sterilization, but UV-C LED products have also been improving in terms of radiant power (optical power). Notably, home appliance brand manufacturers from China, Europe, Korea, and Japan are all planning to integrate UV-C LED technologies into their products, and over 35 manufacturers are introducing or planning to introduce UV-C LED in their products. All in all, various applications are expected to drive up UV/IR LED revenue to $830 million, a 27% increase YoY.

On the whole, the gradual recovery and rebound of demand for traditional LED applications, as well as the upcoming ramp-up of niche LED technologies, will be the main drivers of LED market revenue. At the same time, both demand and revenue in the LED industry are expected to enter an upward trajectory accordingly due to two factors: First, the improvement in the supply and demand situation of the LED industry has allowed prices of most LED products to stabilize, with some products even seeing a price hike; second, emerging LED applications command higher ASPs and gross margins. TrendForce thus believes that LED manufacturers will no longer have to reduce price by increasing order quantity. Companies in the LED industry are therefore expected to post improved earnings as a result.

(Note: The “LED market revenue” indicated in this press release includes revenue from LED package in various applications, as well as revenue from Mini/Micro LED chips directly used in backlighting and other self-emitting products.)

For more information on reports and market data from TrendForce’s Department of Optoelectronics Research, please click here, or email Ms. Grace Li from the Sales Department at graceli@trendforce.com

Subject

Related Articles

Related Reports