Popular Keywords

- About Us

-

Research Report

Research Directory

Semiconductors

LED

Consumer Electronics

Emerging Technologies

- Membership

- Price Trends

- Press Center

- News

- Events

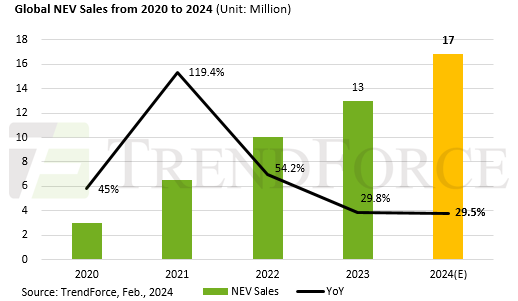

TrendForce reports that global sales of NEVs, including BEVs, PHEVs, and FCVs, reached 13.03 million units in 2023—marking a growth rate of 29.8%. This represents a significant slowdown from the 54.2% growth rate in 2022. Of these, BEVs accounted for 9.11 million units with a growth rate of 24%, and PHEVs reached 3.91 million units, growing at 45%.

TrendForce further notes that China remains the largest market for NEVs, commanding about 60% of the global market share. However, growth is slowing down due to a high base effect, and limited sales growth in other regions cannot compensate for the gap left by the Chinese market. As a result, the growth rate of NEV sales is expected to slow down, with an estimated 16.87 million units sold in 2024 and achieving a growth rate of 29.5%.

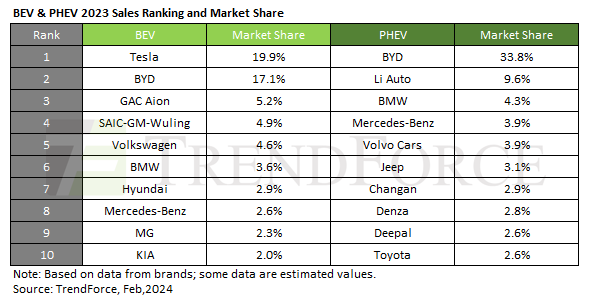

In 2023, Tesla continues to lead BEV rankings with a 19.9% market share, closely followed by BYD, which narrowed the sales gap with Tesla to 248,000 units. This achievement is attributed to BYD’s stable sales performance in China and its growing international presence, bolstered by the activation of overseas bases. TrendForce believes that BYD has the potential to challenge Tesla’s dominance in the BEV market this year.

GAC Aion secured the third spot for the first time, with SAIC-GM-Wuling and Volkswagen falling to fourth and fifth, respectively. Luxury brands BMW and Mercedes-Benz accelerated their electrification efforts, ranking sixth and eighth, while Hyundai Group’s Hyundai and KIA maintained their positions with increased sales.

BYD and Li Auto clinched the top two positions as sellers in the PHEV market, with Li Auto experiencing an impressive 182% growth rate in 2023. Li Auto’s market share rapidly climbed thanks to focusing on the mid-to-large SUV segment and targeting family-oriented consumers. BMW, Mercedes-Benz, and Volvo Cars ranked third to fifth, though BMW and Mercedes-Benz saw declines due to poor PHEV sales in Europe.

Jeep, with a 33% growth rate, rose to sixth place. Additionally, Chinese brands Changan, Denza, and Deepal made their debut in the top ten annual rankings, highlighting the competitive edge brought by the Chinese market. TrendForce anticipates that as Chinese brands accelerate their PHEV exports, traditional automakers will face further pressure on their growth margins.

Notably, as domestic growth in China slows, automakers are not only exporting vehicles from China but also actively establishing overseas bases. TrendForce points out that Chinese brands have significant advantages in terms of vehicle diversity, pricing, and smart features. Once they overcome issues about single production sites, their market is expected to rise rapidly. However, the potential for increased trade barriers could slow down the pace at which Chinese NEVs expand globally.

In the US, the prohibition of Chinese-made battery components starting in 2024 will disqualify many EV models from subsidies. Despite automakers like GM offering equivalent federal tax credits of US$7,500, blocking the Chinese supply chain also makes it more difficult to reduce EV prices.

For more information on reports and market data from TrendForce’s Department of ICT Applications Research, please click here, or email the Sales Department at TRI_MI@trendforce.com

For additional insights from TrendForce analysts on the latest tech industry news, trends, and forecasts, please visit our blog at https://www.trendforce.com/news/